Tax Advice

The study Chichierchia & Partners offers a broad spectrum of solutions to meet the needs of individual and corporate tax accounting business, guaranteeing a specific and timely advice with regard to the declarative aspects. The study also offers any assistance at every stage of the confrontation/contradictory with IRS.

Below is a list of some typical activities at a glance:

- Tax planning for Corporations, sole proprietors and self-employed workers;

- Interpretive opinions, indirect and direct taxation, replacement help;

- Tax and corporate information with the help of circulars and training opportunities update customized to the owners/managers and their employees;

- Formalities at offices/public sector;

- Accounting with accounting, fiscal and social reporting;

- Installation of accounting system, organization and bookkeeping at the client, setting the stock records at the customer’s site;

- Annual financial statement and consolidated financial statement according to the civil code, the national accounting standards (ICOS) and international (IAS,IFRS);

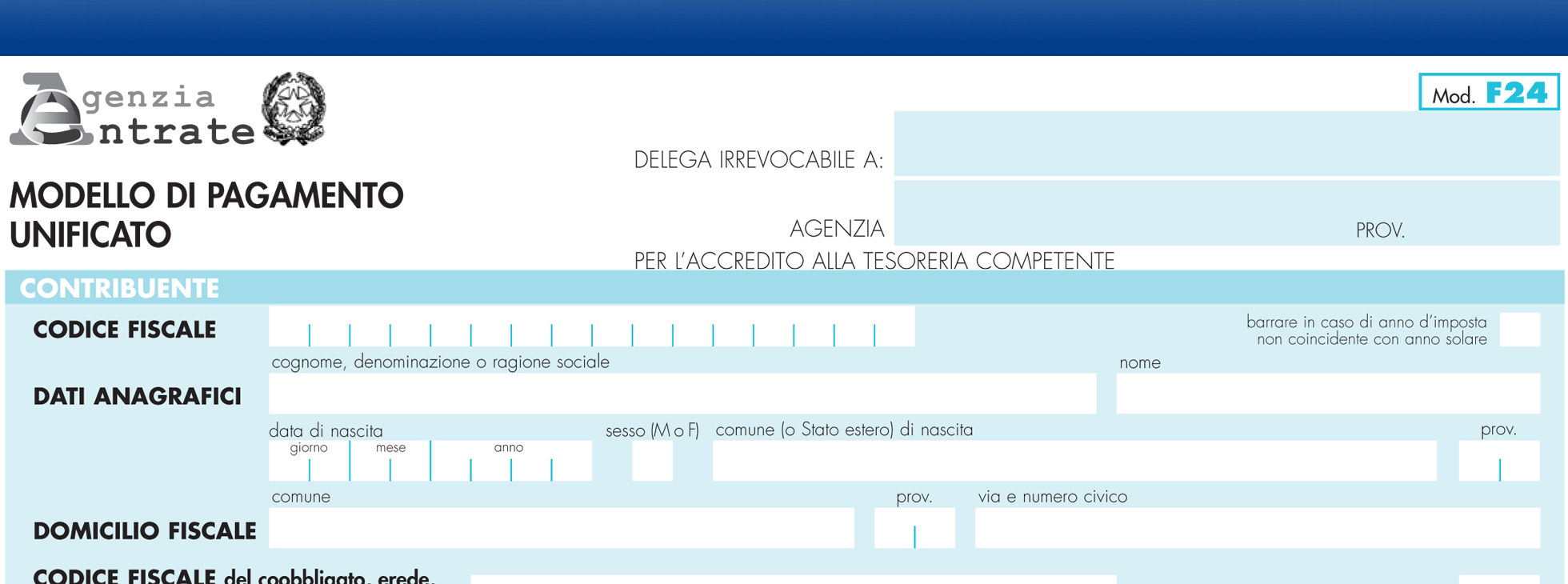

- Drafting tax compliance and assistance for all tax returns.

Fill out the Form to receive information from one of our consultants

English

English Français

Français Italiano

Italiano